It's time for the digital evolution of real estate lending. The Brydg Exchange is a full stack marketplace to standardise real estate lending for scale and transparency.

A sourcing platform for Originators

Available Funding

380,000,000

Capital Providers

23

Interest as low as

6.5% per annum

Summary

Whether you're a Broker, Intermediary, Network, or Packager, we are uniquely positioned as a Lender with a minimum of £100 million of discretionary capital at any given time as well as an Exchange of global family offices and institutional investors who trust us with various mandates.

Top Features

- Loan Management Console with Document Repository

- Instant Offers

- 1 Application/Many Lenders

Criteria:

- Max 75% LTV

- Non owner occupied

By Invitation Only Finfluencer

Affiliates

Loan Size

$100k to $100m

Summary

We believe the world of lending is broken and our mission is to help people unlock the value of tomorrow in their assets of today. This means providing credit in order to realize profits of potential.

We're inviting an exclusive group of financial and real estate influencers to join our journey in reinventing the world of real estate lending. As a Finfluencer, you’ll have access to our proprietary technologies as well as a dedicated credit line for your audience of over $500m for property backed transactions.

Top Features

- Up to $500m of property backed funding

- Interest rates as low as 7%

- Dashboard to manage referral fees

- Dedicated Relationship Manager

- Completely powered by Brydg

A marketplace for Capital

Allocators

Current Loan Enquiries

122,850,000

Average Loan To Value

58.87%

Average Loan Term

12 Months

Summary

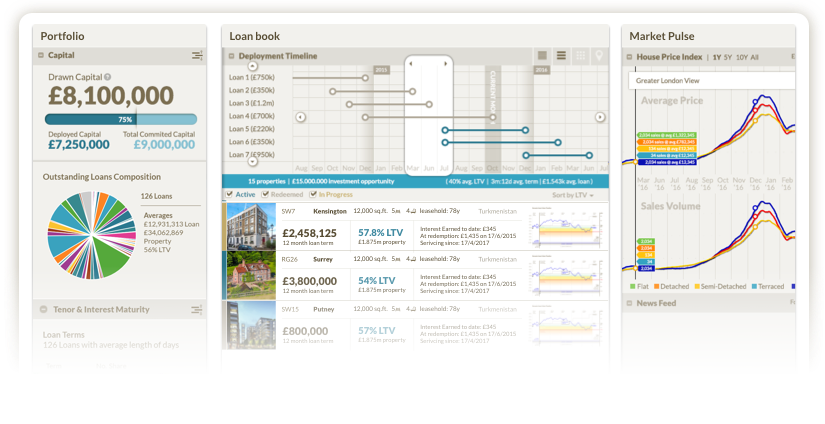

Invest with scale, complete control, short duration and attractive returns.

We directly connect providers of capital with borrowers looking for business loans secured against property. We work with property developers and other individuals and businesses looking for bridge loans, otherwise known as short term credit secured against real estate.

Our platform gives institutional investors scaled access to asset backed loans where we manage the originations process, advise on the credit and underwriting of the loan and even service the loan on behalf of our investors.

Top Features

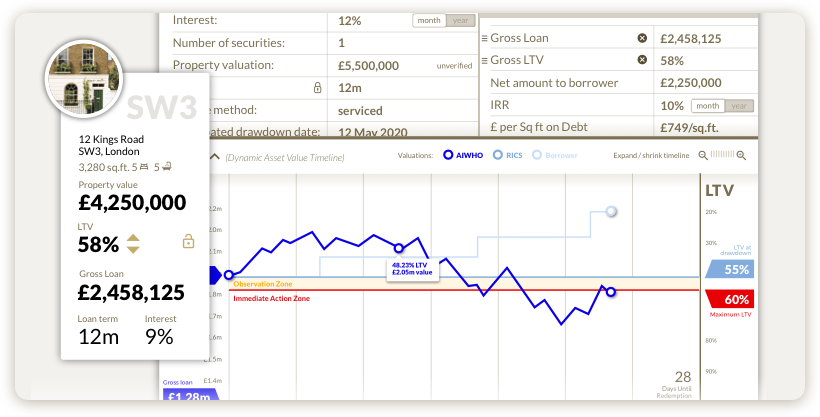

- AIWHO advanced underwriting of borrower, asset and transaction

- Dashboard reporting console with detailed portfolio and loan views containing everything from valuation reports to credit memos

- Dedicated investor relations team to support in all aspects of closing a transaction, from credit assessment to liaising with counter parties

Easy access subject to approval

Criteria:

- £10m minimum capital

Exchange features in The life of a loan

A sneak peek into a Smart Contract ☺

Our team has been lending against UK real estate for over 30 years and we have a trusted reputation which is second to none.

By invitation only

Bespoke Approach

We are not real estate developers, so we don't compete with our clients. We approach every loan with a tailor made strategy, which is unique to the borrower's needs and our investment criteria. Our investment mandates allow us to move with speed whilst our technology and team of real estate and credit veterans are uncompromising on diligence.

Advanced Underwriting

Our proprietary underwriting approach, AIHWO (Artificial Intelligence With Human Oversight), is formed through decades of lending experience coupled with the most advanced technologies and data analytics, which allows us to diligently assess the following loan characteristics:

- The Borrower (e.g. credit history, experience etc.)

- The Asset (e.g. location, area liquidity, property condition etc.)

- The Transaction (e.g. LTV, exit strategy, business plan etc.)

Every loan is put through rigorous diligence with an emphasis on downside protection whilst reviewing the main transaction characteristics where the loan is sufficiently over collateralised to compensate major downturn of the market.

Dynamic Monitoring

The management and servicing of each loan is dynamic in that we are routinely stress testing each loan, from the asset value to the exit strategy, to assure all loan covenants are met at all times without exception. From drawdown of funds through to maturity at redemption, the distance to asset value is tested against regular valuations of the properties and Dynamic Loan Covenants.